Ever since the announcement of LHDN’s e-filing system, many taxpayers are encouraged to adapt and transition into the modern way instead of continuing the old-school paper method of tax filing. The whole process of e-filing your tax can look complicated and feel intimidating, especially for first timers.

The tax filing season for Malaysians just kickstarted on 1st of March 2024!

As opposed to the traditional income tax filing, where we must manually calculate and fill in a printed set of papers, the e-Filing system automatically computes it for us. Taxpayers can now submit their income tax the LHDN e-Filing system on the 1st of March every year unless announced by LHDN (let’s connect to stay informed!).

If you meet the criteria of a tax resident in Malaysia, it’s time to file your income tax with LHDN.

Here are some simple steps to guide you through the process of e-filing for Form BE (Individuals Without Business):

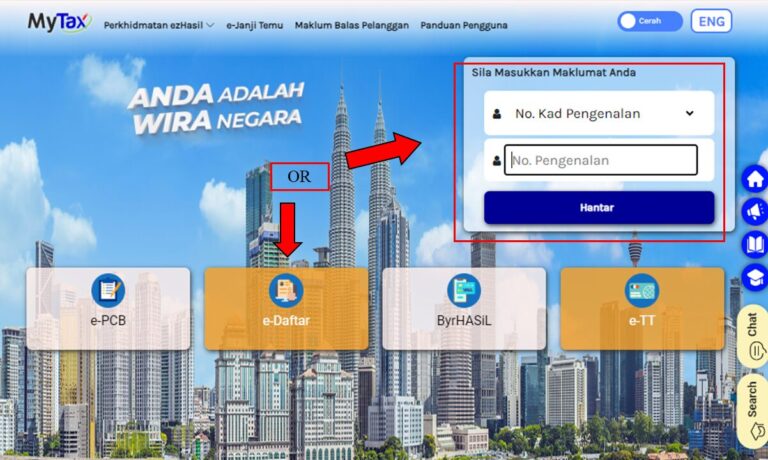

1. Logging in...First time? Register.

Visit the MyTax website (https://mytax.hasil.gov.my/) and log into your account. For registration, click “e-Daftar”.

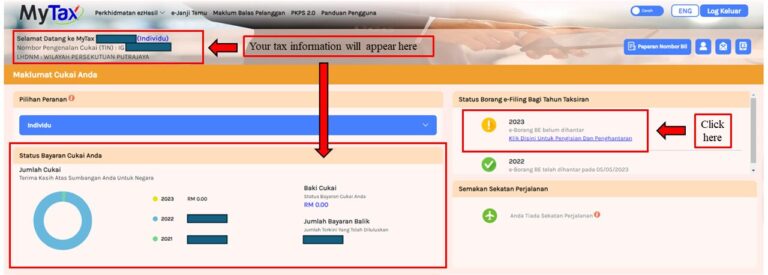

2. Your Tax Information.

After logging in, the “Your Tax Information” page will show up. Choose “2023 e-Borang BE belum dihantar” and then “Klik Disini Untuk Pengisian Dan Penghantaran”.

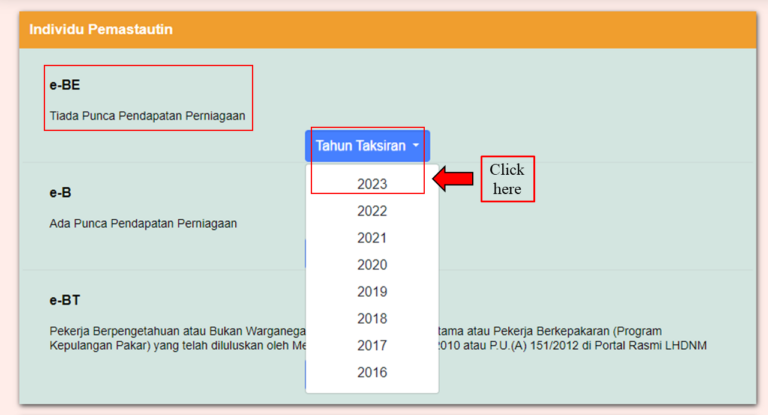

3. The e-Borang page.

You will then proceed to the “e-Borang” page. You can select “e-BE Tiada Punca Pendapatan Perniagaan” and then choose “Tahun Taksiran 2023″ from the drop-down menu.

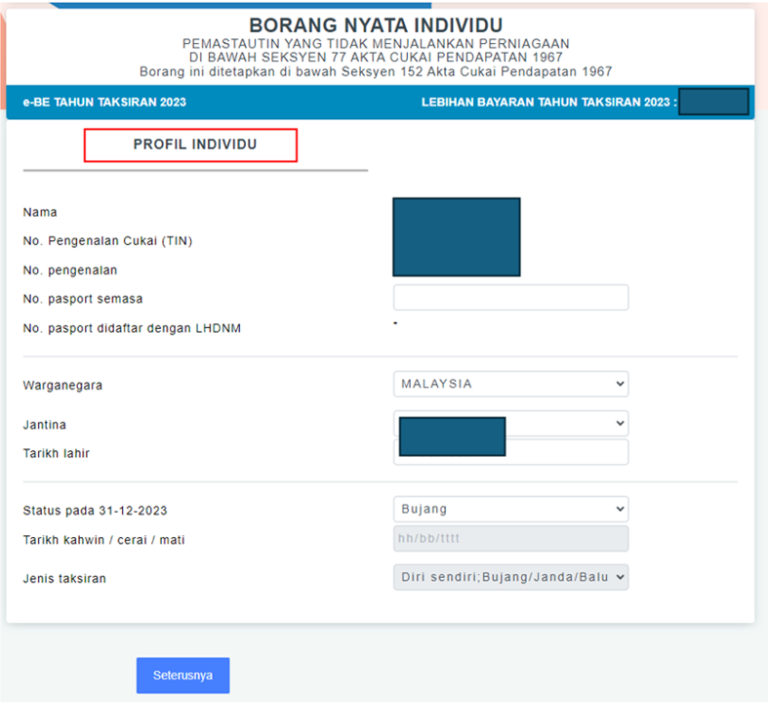

4. Update your profile.

You will be brought to the “Profil Individu” page (enable allow for pop-ups in your browser if this page does not show up). Update your profile details then click “Seterusnya”.

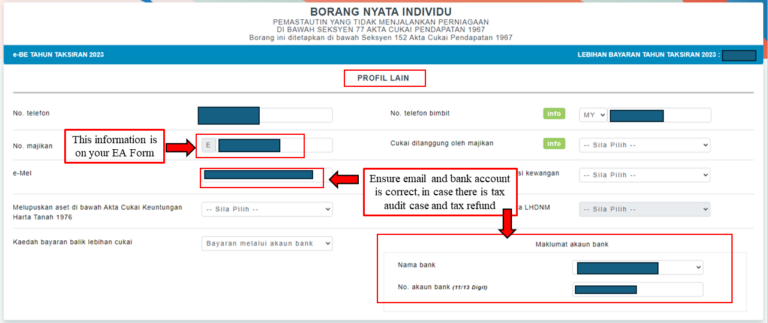

5. Bank details and more...

After that, you will arrive at “Profil Lain”. Make sure that your bank details are correct for refunds in case you overpaid your tax balance. Select “Tidak” for “Cukai Ditanggung oleh Majikan”. Click “Seterusnya” after going through the reference in “TUNTUTAN INSENTIF”.

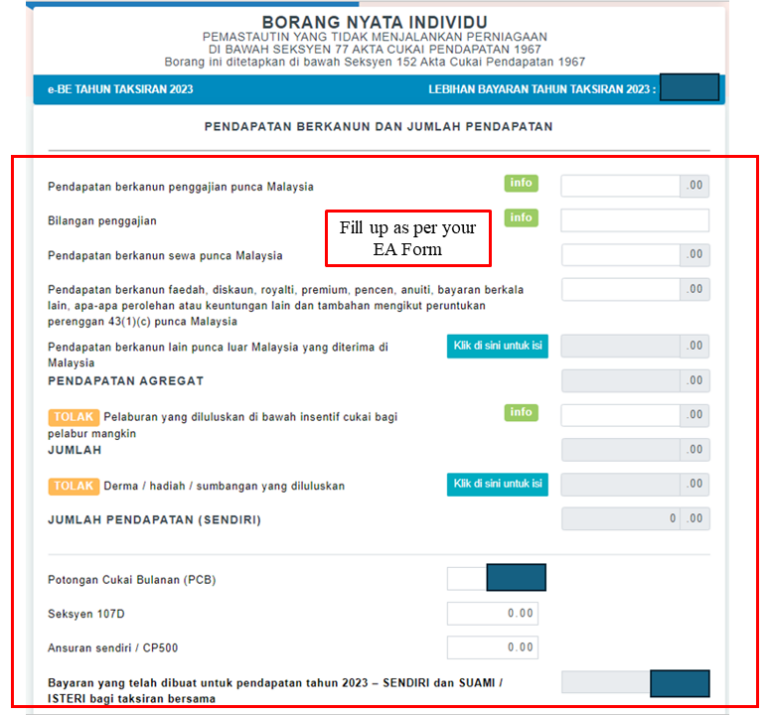

6. Income details.

The next page will need you to fill in necessary information from your EA Form. Fill in If you underwent job changes in 2023, make sure you state the number of companies you worked for in that year for “Bilangan Penggajian”. For people who did not undergo any job changes, just state 1. Go through the reference in “Pendapatan Bukan Penggajian” and click “Seterusnya”.

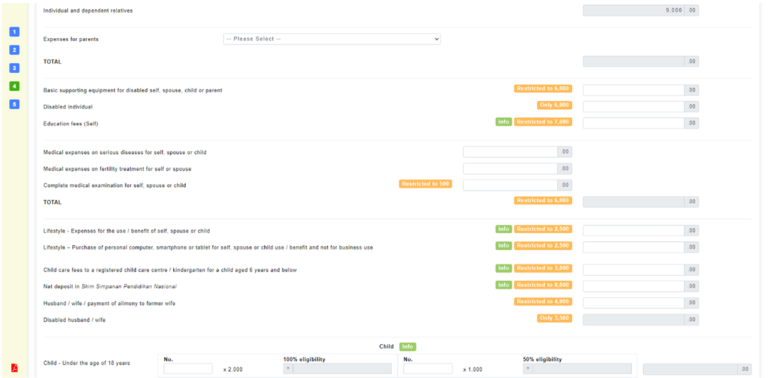

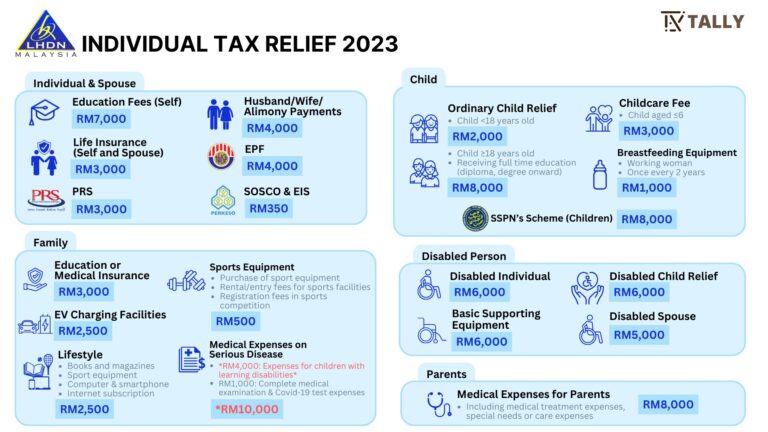

7. Claim tax relief.

You will proceed to the “PELEPASAN” page for claiming tax relief (prepare relevant documents like invoices and receipts beforehand). Refer to the photo below on tax reliefs for 2023. (Source: https://www.hasil.gov.my/individu/kitaran-cukai-individu/lapor-pendapatan/pelepasan-cukai/)

8. Check summary and declare.

After completing that, you will be directed to the summary of details filled in previously. Do review carefully before submitting your declaration. When you click to submit the declaration, you will be required to enter your identification number (IC) and your MyTax account password.

9. Tax refund...end!

At last, you’ll see the amount of tax refund you’re entitled to for 2023. And that’s about it!

Oh, the deadline is 30th April 2024! Hope this post reaches you just in time.

Take care!

Connect with us to be informed with latest career and employment insights. Tally is a leading recruitment agency in Malaysia, specializing in providing comprehensive recruitment solutions for white-collar professionals. We help Fortune 500 companies, MNC, public listed companies, IPO, large-scale enterprises, small and medium businesses in achieving their recruitment goals and fulfilling their hiring needs.

You can also drop your resume at info@my-tally.com and see if we can match you with your next job!